EffiScore

|

| Credit Risk Analysis and the creation of Analytical Engines for Credit Scoring.

Personalized Credit Analysis Current tools for credit evaluation rely on reports from a credit bureau, a generic score card or a combination of both. But these methods omit the analysis of the specific credit product and its behavior on its target market. EffiScore provides an alternative in which both the product and the client base can be evaluated over time to provide an engine that allows discriminating between good or bad clients. Better products for Customers The credit department will be able to understand client behavior and design specific products for different needs. A combination of price, fees, and other conditions will take into account the specific risk that each client represents. Efficiency in the Credit Analysis EffiScore increases de speed and efficiency in the loan process. Clients will have a quicker response, conditions will match their risk profile and the institution will be able to grow faster with less risk in its credit portfolio. EffiScore benefits:

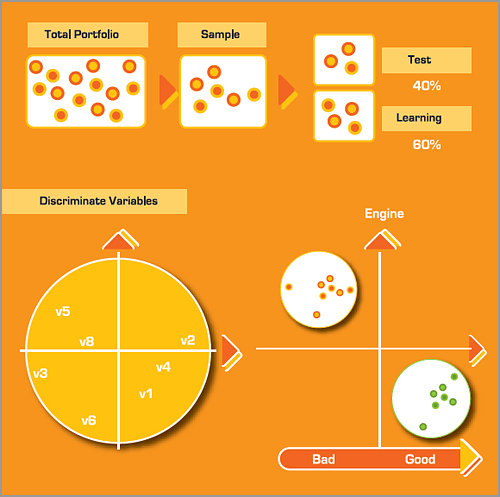

EffiScore provides a strong method to avoid granting loans with a high probability of default. Financial Institutions using EffiScore will be able to increase their loan portfolios and avoid the risk of deteriorating its quality. Technology to learn and apply the knowledge EffiScore includes specific techniques using statistical and mathematical methods to predict behavior based on Discriminate Analysis. Using qualitative and quantitative variables, EffiScore creates a decision engine that is unique for each financial institution and avoids the use of generic variables and methods which are used in other sectors or countries. EffiScore estimates the probability of bad loans at the point of granting the loan and throughout is life. Portfolio Classification Based on current and historic portfolio, EffiScore will create a made to measure solution that will explain the portfolio behavior based on mathematical regressions of the variables that most contribute to the differentiations between good and bad payers. Each solution can be defined at a product, sector or regional level. Personalized Products and Services The financial institution will have an objective and consistent evaluation of its credit risk based on the most advanced technology. It will be able to price each loan according to the risk in each case. Risk Management EffiScore allows a level of risk measurement for the portfolio and for each contract. The financial institution will then be able to justify different levels of provision for each loan and estimate its expected and unexpected losses on the portfolio. |

|